Highlights of the Union Budget 2024-2025

Nirmala Sitharaman, the Union Finance Minister, presented the Union Budget for the upcoming fiscal year (2024-25).

The Budget is an interim one since it’s the final one before the Lok Sabha elections.

No modifications were made to the tax slabs. Meanwhile, 5.1% of GDP was designated as the fiscal deficit target for 2024–25 (FY25), which measures the difference between government revenue and expenses.

Sitharaman provided a vision for the upcoming years, stating that there will be unparalleled growth over the next five years. She declared that capital expenditures by the government would amount to Rs 11.1 lakh crore in the upcoming fiscal year, an increase of roughly 11% over the allocations for the current fiscal year.

According to Finance Minister Nirmala Sitharaman, the Indian economy has experienced significant transformation over the past ten years.

udget 2024 has arrived. Assetmonk breaks down the key takeaways for you.

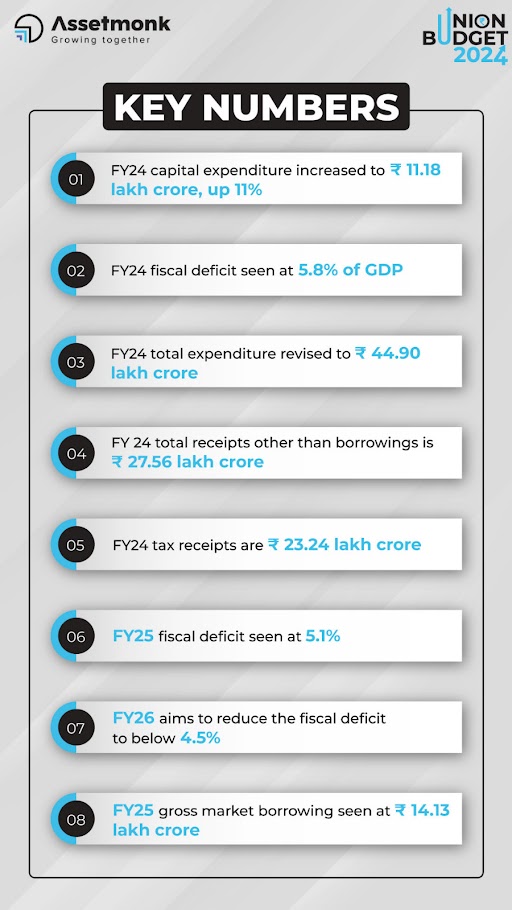

Highlights of the Union Budget 2024-2025: Key Numbers

Here are the key numbers that highlight the targets of the 2024 budget:

Key macroeconomic points from the Interim Budget:

- The target for fiscal deficit for FY25 is 5.1% of GDP, while it is expected to be 5.8% for FY24.

- The government aims to reduce the fiscal deficit to below 4.5% by FY26.

- The capital expenditure outlay for FY25 is set at 3.4% of GDP.

- The expected net market borrowing for FY25 is ₹11.75 lakh crore, while it is estimated to be ₹14.1 lakh crore for FY24.

- The revised estimates for total expenditure for FY24 are at ₹44.90 lakh crore.

- The divestment target for FY25 is ₹50,000 crore, whereas it has been reduced to ₹30,000 crore for FY24.

PMs take on the Union Budget 2024

Prime Minister Narendra Modi affirmed that the Union Budget 2024, presented by Finance Minister Nirmala Sitharaman, guarantees the strengthening of the foundation of a developed India. Here are the key highlights from PM Modi’s statement:

- The budget will empower the young, poor, women, and farmers— the four pillars of a developed India.

- This budget is focused on creating India’s future and reflects the aspirations of a young India.

- The budget empowers the poor and middle class and creates numerous employment opportunities for the youth.

- The budget is “historic” and offers rebates for start-ups.

- It includes provisions for significant capital expenditure of ₹11.11 lakh crore while maintaining control over the fiscal deficit.

Direct and Indirect Tax

- Finance Minister Nirmala Sitharaman suggests maintaining the current tax rates for both direct and indirect taxes, including import tax.

- The tax rates for direct and indirect taxes will remain unchanged.

- The tax benefits for startups and investments made by sovereign wealth funds have been extended until March 31, 2025.

- The government plans to withdraw old disputed direct tax demands, amounting to Rs 25,000 up until FY2009 and Rs 10,000 from 2010-11 to 2014-15. This move will benefit 1 crore taxpayers.

- Additionally, the Finance Minister also unveils tax benefits for pension funds.

India Growth

- In the next five years, India will experience unprecedented growth.

- The government aims to make the eastern region the driving force behind India’s growth.

- Under the new Solar power policy, more than 1 crore houses will receive 300 units of free power.

- The government has significantly saved by directly transferring the beneficiaries Rs 34 lakh crore.

- Over the past 10 years, the Indian economy has undergone a remarkable transformation.

- The country is facing significant challenges, which the government has overcome by Sabka Saath Sabka Vishvaas.

- Our highest priority is addressing the needs of the poor, youth, women, and farmers.

Real Estate

- The interim budget introduced a new housing plan for the middle class, targeting constructing 2 crore houses under the PM Aavas Yojana.

- As Pradhan Mantri Awas Yojana (Grameen) nears the goal of 3 crore houses, an additional target has been set of constructing 2 crore more houses in the next five years.

- While the Interim Budget 2024 did not unveil any significant or unexpected announcements for Real Estate, it will continue to prioritize infrastructure upgrades and nationwide connectivity. There is optimism that these measures would contribute to the growth of the real estate sector, including tier-2 & tier-3 cities.

- The interim budget has remained silent on tax incentives for homebuyers, for example, increasing the deduction limit on home loan interest under Section 24.

- Real estate stocks saw a slight dip today due to a lack of any big significant announcements in the budget regarding the sector.

- However, an increase of 11.1% in the Capex outlay to Rs 11.11 lakh crore has significant potential for real estate development, with a focus on the sector’s development and new projects.

Railways & Connectivity

- RS 2.55 lakh crore were allocated for the railway sector. Under the PM Gati Shakti Initiative, there will be a focus on major economic railway corridors in the country.

- ·Conversion of 40,000 normal train bogies into high-speed Vande Bharat ones to enhance rail transportation.

Fiscal Landscape

- Substantial capex outlay of Rs 11.11 lakh crore, constituting 3.4% of the GDP.

- Revised fiscal deficit targets: 5.8% for FY24, 5.1% for FY25, and plans to reduce it to 4.5% in 2025-26.

- Gross market borrowing targets for FY25 set at Rs 14.13 lakh crore, with net market borrowing estimated at Rs 11.75 lakh crore.

- Revised expenditure for FY24 is Rs 44.90 lakh crore, and total revenue receipts in 2024/25 are estimated at Rs 30 lakh crore.

Agriculture

- In the Agriculture sector, both private and public sector support will be given for promoting investment, especially in post-harvest activities.

- Expansion of the application of Nano-DAP across all agro-climatic zones.

- The government plans to give direct financial assistance to 11.8 crore farmers under the PM-Kisan scheme, and crop insurance will be provided to 4 crore farmers under PM Fasal Bima Yojana.

- Five integrated Aqua Parks to be set up, and the government to launch Blue Economy 2.0 to promote aquaculture.

PLI Scheme

A significant boost was given to the Production-Linked Incentive (PLI) scheme with an allocation of Rs 6,200 crore.

Healthcare and Renewable Energy

- Steps have been taken for improved delivery of nutrition and early childhood care and development. The Saksham Angwanwadi scheme and Poshan 2.0 will facilitate the achievement of these goals.

- Healthcare facilities under Ayushman Bharat will be extended to all Aasha and Aanganwadi workers.

- Financial assistance for procurement of biomass aggregation machinery will be renewable energy sector.

- 1 crore households can be eligible to obtain up to 300 units of free electricity per month.

Tourism

- When it comes to Tourism, interest-free loans will be provided to states for the promotion of tourism.

- Specific funds will be allocated for the development of tourism in Lakshadweep.

The next ‘full budget’ is scheduled to be presented in July after a new government has taken office following the Lok Sabha elections.

Frequently Asked Questions

1. What is the fiscal deficit target for the upcoming fiscal year (2024-25) according to the Union Budget?

The fiscal deficit target for FY25 is set at 5.1% of GDP, with a further reduction expected to below 4.5% by FY26.

2. How much has the capital expenditure outlay been increased for the upcoming fiscal year?

The capital expenditure outlay for FY25 is set at Rs 11.1 lakh crore, representing an increase of approximately 11% over the allocations for the current fiscal year.

3. What are the key points regarding Direct and Indirect Tax in the Union Budget?

The budget suggests maintaining current tax rates for both direct and indirect taxes, with no changes to the tax slabs. Tax benefits for startups and investments by sovereign wealth funds are extended until March 31, 2025.

4. How is the real estate sector expected to be impacted by the Union Budget?

While the Interim Budget did not unveil significant announcements for real estate, it continues to prioritize infrastructure upgrades and nationwide connectivity. However, an 11.1% increase in the Capex outlay to Rs 11.11 lakh crore holds significant potential for real estate development.

Listen to the article

Listen to the article